Deep Dives - Maker DAO

Maker DAO is a well-known protocol that has been a pioneer in the decentralized finance (DeFi) space. In 2021, Maker Foundation took a significant step towards decentralization by dissolving itself and spinning up a DAO. As someone who has delved deep into the inner workings of Maker DAO over the past two weeks, I’ve gathered valuable insights and resources that will help anyone start contributing to Maker DAO.

Major Events

-

The End Game Proposal - Last year, Rune Christensen, the founder of Maker DAO, put forth a proposal that outlined the constitution and end game for Maker DAO. This proposal aimed to streamline the governance structure and achieve true decentralization. This proposal has been considered one of the largest restructurings in its history and the proposal has passed with significant support.

-

Hasu’s Proposal - Hasu, a Maker DAO delegate, had put forward a proposal advocating for the creation of a constitution and a council of Makers. This proposal had sparked debate within the Maker community as it presented a differing perspective compared to Rune’s proposal and resulted in a division of opinions

-

Mitigating PSM concerns during Tornado Cash Sanctions : In June 2022, a number of Maker DAO members expressed concerns about the protocol’s reliance on USDC to maintain the stability of DAI’s peg. This was due to the fact that Circle, the company behind USDC, had blacklisted addresses associated with Tornado cash. This raised questions within the Maker DAO community about the possibility of Circle blacklisting USDC in the PSM vault, which would have a major impact on DAI’s stability. The PSM vault, which held $3B worth of USDC, was not generating any returns for Maker DAO and posed a significant risk to DAI’s peg. To mitigate the risks associated with relying solely on USDC, the Maker DAO community undertook two major initiatives.

- Generating 1.5% reward on $1.6B worth of assets through Coinbase institutional rewards program.

- Giving $500M assets to Monetalis to deploy those funds or buying treasuries and deploying it to real World Assets.

- Onboarding Real World Assets : To address the concerns regarding DAI’s peg and diversification of the collateral asset class, Maker DAO introduced Real World Assets (RWA) as collateral for DAI. As a significant milestone, Maker DAO successfully onboarded Huntingdon Valley Bank to open a $100M DAI loan, creating a huge buzz in both the DeFi and TradFi World.

Maker’s Governance

- Off chain governance - Off-chain governance refers to processes for making decisions that don’t require on-chain voting and gathering feedback prior to on-chain voting. Off-chain governance happens on the Maker Governance Forum, where the community meets to propose and discuss new proposals. Anyone can participate in off-chain governance.

-

Informal Polls - Informal Polls make use of the forum’s support for poll creation. Informal Polls provide a set of options for the community to vote on. Although more structured than discussions, they cannot effect protocol changes nor trigger processes immediately; they are commonly used to measure community sentiment about issues affecting the MakerDAO ecosystem. Informal Polls can be created by anyone and there are no guidelines on the general use of Informal Polls other than courtesy and common sense.

-

Signal Requests Signal Requests are the most immediately powerful means of effecting change off-chain. Signal Requests are a type of poll whose specific parameters and necessity are established by processes that have been ratified within the MIPs Framework. The nature of the effects of Signal Requests can vary greatly in accordance to the MIP-ratified process that requires or allows Signal Requests.

-

Governance Polling - Polling proposals are voted upon by MKR holders. Governance Polls occur on-chain and are used to measure the sentiment of MKR voters. Polls often run concurrently, allowing voters to participate in any number of them at the same time. Polls may have different formats like Binary Voting, Instant Run-Off Voting, or Approval Voting depending on the topic.

-

Executive Votes - Executive Votes execute technical changes to the Maker Protocol. When active, each Executive Vote has a proposed set of changes being made to the Maker Protocol’s smart contracts. Executive Votes use a Continuous Approval Voting model. Executive Votes can occur at any time, but the current schedule calls for Executive Votes to go live on Wednesdays.

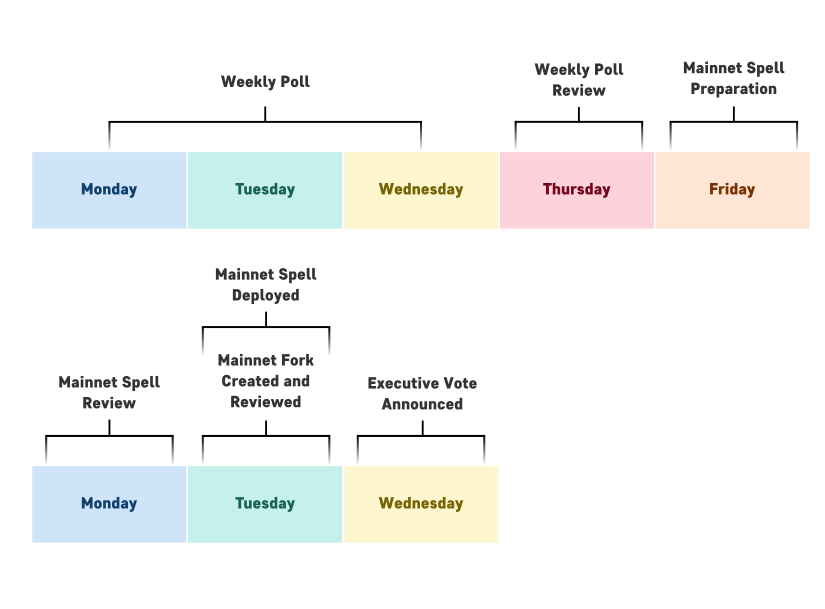

The MakerDAO’s governance cycle is split into two distinct time frames

This diagram provides a comprehensive overview of Maker DAO’s governance

Tokenomics

You can think of Maker DAO as a bank that provides lending services in a permissionless manner, where borrowers are required to lock in collateral. Whenever a user deposits collateral, Maker DAO generates its own stablecoin, DAI, on the blockchain. Borrowers have the freedom to use DAI as they please, but they are charged a stability fee by Maker DAO as long as they hold DAI. To understand the tokenomics of Maker DAO, you can refer to the diagram below.

To get a comprehensive understanding of Maker DAO’s tokenomics, I recommend going through this video and this article

To quote one of the Core Unit Members of Maker DAO from my recent conversation “It is an exciting time to start contributing to Maker DAO, as the organization is undergoing a major shift that will create many opportunities.I’d suggest folks who want to contriute to lurk around Discord and the forum and start contributing to the discussions”

Resources